If you’ve recently checked your bank account and noticed the phrase hold rel mem cr meaning, you’re not alone. This mysterious-looking banking entry can cause confusion, especially when money appears to be pending, restricted, or temporarily unavailable. While it may look technical, the actual explanation behind it is straightforward once you understand how banks process transactions.

In modern banking systems, transaction codes and abbreviations are used to simplify internal operations. However, customers often see these short codes without context. That’s exactly why understanding hold rel mem cr meaning matters. It helps you know whether your money is delayed, cleared, reversed, or simply under processing.

This in-depth guide breaks everything down in plain language. From how banks process deposits to why transaction holds exist, you’ll get a complete understanding of what this code represents, how it impacts your available balance, and what steps to take if something doesn’t look right.

Understanding Banking Transaction Codes and Abbreviations

Banks rely heavily on transaction codes. These codes allow financial institutions to categorize and process millions of transactions efficiently every single day. Instead of writing long explanations for every deposit, transfer, or reversal, banks use standardized abbreviations in account statements and online banking portals.

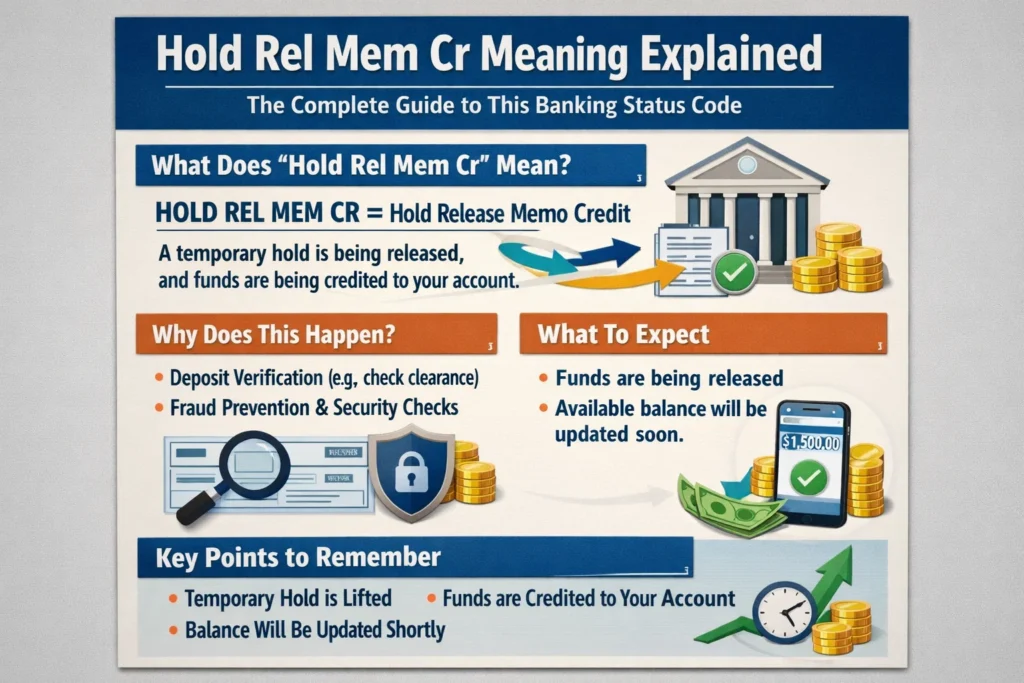

The phrase hold rel mem cr meaning fits within this system of abbreviations. Each part of the phrase represents a specific function in transaction processing. “Hold” usually refers to a temporary restriction placed on funds. “Rel” typically stands for “release.” “Mem” often means “memo” or memorandum entry, indicating a pending or temporary record. “Cr” stands for credit, meaning money being added to the account.

In simple terms, this code suggests that a held memo credit has been released. That means funds that were previously pending or restricted are now available. However, the exact interpretation can vary slightly depending on your bank’s internal system.

Transaction abbreviations like ACH credit, pending debit, provisional credit, and memo posting are all part of the same framework. Banks process money in stages. First, a transaction is authorized. Then it is posted as a memo or pending item. Finally, it is cleared and settled. Understanding this lifecycle makes the hold rel mem cr meaning much easier to grasp.

What “Hold” Means in Banking

A hold in banking refers to a temporary restriction placed on funds. This often happens when you deposit a check, receive a large transfer, or when a transaction requires verification. During the hold period, the money may appear in your account but cannot yet be withdrawn or used.

Banks apply holds to reduce risk. For example, if you deposit a check, the bank needs time to confirm that the issuing bank will honor the payment. Until that confirmation happens, the funds may remain unavailable. Once verification is complete, the hold is lifted.

In the context of hold rel mem cr meaning, the word “hold” indicates that the funds were initially restricted. This does not mean something went wrong. It simply means the bank followed standard verification procedures.

Holds can also apply to debit card purchases, hotel reservations, fuel station payments, and online transactions. In such cases, an amount is temporarily blocked to ensure sufficient funds. Once the merchant finalizes the charge, the actual amount replaces the hold.

The Role of “Memo Credit” in Account Activity

The word “memo” in banking refers to a temporary or pending entry. It’s like a placeholder that shows a transaction is in progress. A memo credit means money is expected to enter your account, but it has not yet fully cleared.

For example, when someone transfers money to you via ACH, your bank may show a memo credit before final settlement. This allows you to see incoming funds before they officially clear. However, you may not be able to spend them until processing is complete.

In hold rel mem cr meaning, “mem cr” stands for memo credit. That indicates that the credit was initially recorded as pending. Once the hold is released, the memo entry becomes a finalized transaction.

Memo credits are common in direct deposits, refunds, wire transfers, and mobile check deposits. They provide transparency while banks complete background verification.

Breaking Down hold rel mem cr meaning in Simple Terms

Now let’s combine everything together. The phrase hold rel mem cr meaning can be interpreted as:

A previously held memo credit has been released and made available in your account.

This means:

• Funds were pending

• A hold was applied

• The hold has now been released

• The credit is fully posted

This is usually a positive update. It signals that your funds are now accessible. There is no penalty or deduction associated with this code in normal circumstances.

Below is a table summarizing the components:

| Term | Meaning | Impact on Account |

|---|---|---|

| Hold | Temporary restriction | Funds unavailable |

| Rel | Release | Restriction removed |

| Mem | Memo (pending entry) | Temporary record |

| Cr | Credit | Money added |

Understanding this structure eliminates confusion and helps you monitor your available balance more accurately.

Why Banks Place Holds on Credits

Banks operate under risk management policies and regulatory compliance guidelines. When money moves between financial institutions, there is always a settlement period. This is especially true for check deposits and ACH transfers.

Federal regulations often define maximum hold periods. For example, local checks may clear within one business day, while larger or out-of-state deposits can take longer. Fraud prevention systems also trigger holds automatically when transactions appear unusual.

When reviewing hold rel mem cr meaning, it is important to remember that the hold phase is part of a protective measure. Banks must ensure that funds are legitimate before allowing withdrawal. This protects both the institution and the customer from overdrafts or fraudulent reversals.

In some cases, holds are shorter than expected, especially for long-standing customers with a solid transaction history.

Situations Where You Might See This Code

You may encounter this transaction description in several common situations. Direct deposits from employers sometimes appear first as memo credits before becoming finalized. Once processing completes, the system may log the release using a code like this.

Mobile check deposits frequently trigger hold policies. After submission through your banking app, the deposit shows as pending. Once verified, the hold is lifted, and the transaction updates accordingly.

Refunds from merchants can also create this entry. Credit card overpayments, returned purchases, and ACH reimbursements may follow the same processing flow.

In all these cases, hold rel mem cr meaning signals the completion of the processing cycle.

How This Affects Your Available Balance

When funds are under hold, your ledger balance may differ from your available balance. The ledger balance shows total funds including pending credits. The available balance shows money you can actually use.

Once the hold is released, the available balance increases. This is why understanding hold rel mem cr meaning is helpful. It confirms that the funds have moved from pending to usable status.

If you track your spending carefully, this distinction prevents accidental overdrafts. Many banking apps display separate lines for pending transactions and posted transactions to make this clearer.

Common Misunderstandings About Transaction Holds

Some account holders assume that a hold indicates a problem. In reality, holds are standard banking procedures. They do not automatically mean fraud, account suspension, or transaction failure.

Another misconception is that holds are random. In fact, they follow specific risk-based rules. Deposit amount, transaction source, account age, and past history all play a role.

Understanding hold rel mem cr meaning reduces anxiety. It shows that the transaction lifecycle has simply progressed to the next stage.

The Processing Timeline for Credits

Credit transactions typically follow several steps. First, authorization occurs. Then a memo entry is created. Next, the bank applies any necessary hold. Finally, settlement happens and the hold is released.

This structured workflow ensures compliance with payment network regulations. Electronic transfers may settle within one business day, while check deposits can take longer depending on verification needs.

The release stage is usually automatic. Once verification clears, the system updates your account. That’s when you might see the hold rel mem cr meaning reflected in your statement history.

Aavot app: The Complete Guide to Features, Benefits, and Real-World Use

Security and Fraud Prevention Measures

Banks use automated monitoring tools to detect suspicious activity. If a deposit appears irregular, an extended hold may apply. This is not a punishment but a protective safeguard.

Fraud schemes often involve fake checks or reversed electronic transfers. By holding funds temporarily, banks prevent situations where customers withdraw money that later turns out to be invalid.

The release entry confirms that verification has been completed. It provides reassurance that the credit is legitimate and settled.

Differences Between Pending and Posted Transactions

Pending transactions are temporary. Posted transactions are finalized. The difference is important when reconciling your statement.

Memo credits belong to the pending category. Once the hold is removed, they move into the posted section. That transition is reflected by codes similar to hold rel mem cr meaning.

Understanding this distinction helps when balancing accounts, budgeting, or reviewing monthly statements.

How to Respond If Something Looks Wrong

Although most releases are routine, you should still monitor your account. If funds remain unavailable longer than expected, contact your bank’s customer support team.

Keep documentation of deposit receipts, transfer confirmations, and payment references. This makes it easier for representatives to investigate.

Banks generally provide estimated availability timelines in their deposit agreements. Reviewing these policies gives clarity about expected hold durations.

Expert Insight on Transaction Transparency

Financial experts often emphasize clarity in digital banking. As one banking compliance specialist noted, “Clear transaction labeling reduces customer confusion and builds trust.” Transparent processing codes are designed to improve visibility rather than obscure information.

Modern online banking platforms continue improving transaction descriptions. Still, internal abbreviations occasionally appear due to legacy systems.

Regulatory Framework and Compliance

Financial institutions operate under national banking regulations that define how funds must be handled. These regulations ensure fairness and protect consumers from unnecessary delays.

Electronic payments follow standardized clearing house procedures. Settlement rules govern how quickly banks must release verified funds. This structured compliance environment ensures consistent processing timelines.

The release reflected in hold rel mem cr meaning typically indicates regulatory requirements have been satisfied.

Digital Banking and Real-Time Updates

With the rise of mobile banking, transaction visibility has improved dramatically. Customers can now track deposits in near real-time. Push notifications often alert users when funds become available.

However, real-time visibility does not eliminate backend processing. Verification steps still occur even if they are invisible to the customer.

When the hold is released, systems update instantly. That update appears in your transaction list, reflecting the finalized credit.

Conclusion

Understanding hold rel mem cr meaning removes uncertainty from your banking experience. Instead of worrying about technical jargon, you can interpret it confidently as a positive update. It means a previously pending credit has completed processing and is now available for use.

Transaction holds are normal parts of financial operations. They protect both banks and customers by ensuring funds are legitimate before full access is granted. Once verification completes, the release entry appears in your account history.

By learning how banking transaction codes work, you gain greater control over your finances. Monitoring available balance, understanding pending entries, and recognizing release notifications help you manage money with clarity and confidence.

FAQs

What does hold rel mem cr meaning indicate on my bank statement?

It indicates that a memo credit that was previously on hold has been released and fully posted to your account. The funds should now be available for withdrawal or spending.

Is hold rel mem cr meaning a bad sign?

No, it is generally a positive update. It shows that the bank has completed verification and removed the hold on your credit transaction.

How long do banks usually keep funds on hold?

Hold durations vary depending on deposit type and risk factors. Check deposits may take one to several business days, while electronic transfers often clear faster.

Why was there a hold before the release?

Banks place holds to verify funds and prevent fraud. The hold ensures the deposit is legitimate before allowing access. Once confirmed, the release occurs.

Can hold rel mem cr meaning appear for refunds?

Yes, refunds and reimbursements often follow the same processing pattern. They may show as memo credits first, then update once the hold is released and the credit is finalized.